vermont sales tax food

Businesses have a nightmare to maintain and track. Retail sales of tangible personal property are always subject to Vermont Sales Tax unless specifically exempted by Vermont law.

Vermont Sales Tax Handbook 2022

What is sales tax on food in Vermont.

. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax. A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in. This applies to any sale.

The sales tax rate is 6. Sales and Use Tax Exemptions. An example of items that are exempt from Vermont sales.

While many other states allow counties and other localities to collect a local option sales tax. A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants. An establishment that has made total sales of food or beverage in the previous taxable year of at least 80 taxable food and beverage.

What is the food sales tax in Vermont. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from.

EXEMPT Food Food Products and Beverages Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Soft drinks however do not include milk or milkmilk substitute.

Are groceries taxed in Vermont. In Vermont certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The Shelburne Vermont sales tax is 600 the same as the Vermont state sales tax.

An example of an item that is exempt from Vermont sales tax are items. A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in. Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law.

Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. The state sales tax rate in Vermont is 6000. Are Food and Meals subject to sales tax.

A new establishment that projects its total sales for. The Vermont Meals and Rooms Tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when renting a room. Vermonts food and beverage sales tax exemption does not extend to soft drinks or sweetened beverages.

974113 with the exception. A sales tax of 6 is imposed on the retail sales of tangible personal property TPP unless exempted by Vermont law. If you are a new business go to.

Groceries clothing prescription drugs and non-prescription drugs are exempt from the. Vermont has a statewide sales tax rate of 6 which has been in place since 1969. 974113 with the.

Vermont VT Sales Tax Rates by City. Sales tax is destination. If you are a new business go to Getting Started with Sales and Use Tax to learn the basics of Vermont Sales and Use Tax.

Vermont Sales and Use Tax Sales Tax. With local taxes the total sales tax rate is between 6000 and 7000. But there is endless.

Vermonts latest tax restructuring proposal addresses neither of these concerns -- it offers no substantive plans to fairly redistribute sales taxes on food. While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales.

Sales Taxes In The United States Wikipedia

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

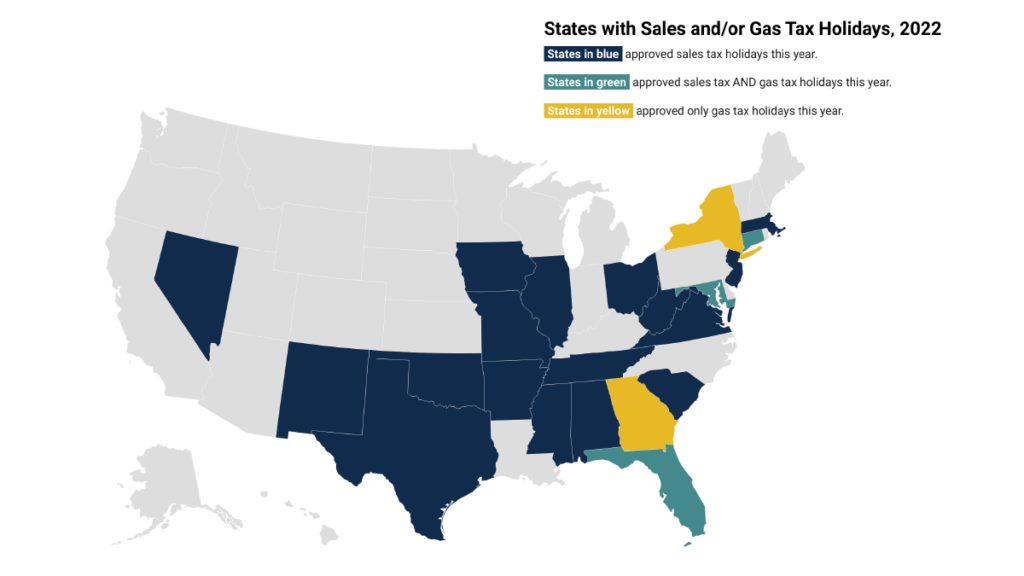

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep

Sales Tax Amnesty Programs By State Sales Tax Institute

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Online Menu Of Hillmers On Main Restaurant Newport Vermont 05855 Zmenu

Vermont The Most Vaccinated State In The Nation Has Been Weathering A Spike In Covid Cases But Why The Boston Globe

Wellness Springfield Food Co Op

Traditional Foods Online Vermont Maple Products

Are Vermonters Paying The State S Mandatory Use Tax Spoiler Nope Economy Seven Days Vermont S Independent Voice

The Vermont Country Store Cookbook Orton Family Recipes

No Vt Sales Tax For Non Residents Buy A Subaru In Vermont At Brattleboro Subaru

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)